The Spanish property market in 2025 — record price growth and new challenges

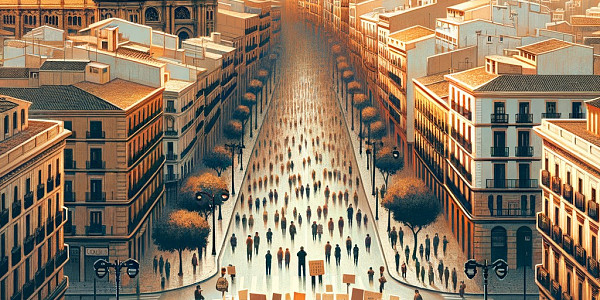

In February 2025, the Spanish housing market continues to show unprecedented price growth, especially in popular regions such as Madrid, the Canary Islands and Valencia. However, new challenges are already looming on the horizon in the form of tax changes and a growing shortage of affordable housing.

Rapid growth in housing prices and regional differences

As of January 2025, the average price per square meter of housing in Spain reached 2,237 euros, which is 9.2% higher than the same period last year[1]. However, in some regions, this growth was even more impressive: Madrid: +18.6%, Canary Islands: +16.3%, Valencia: +14.6%. This growth rate is significantly ahead of the national average, which indicates serious imbalances in the regional property markets. The reasons for this are increased demand from both local and foreign buyers, as well as a limited supply of new properties. It is interesting to note that price growth is observed not only in the new-build segment, but also in the secondary market. For example, in Madrid, the cost of the secondary market has increased by 15.4% over the year, and in Barcelona — by 12.1%. This suggests that demand for housing remains high regardless of its age and condition.

Experts' forecasts for 2025 — moderate growth or a new boom

- Despite the dizzying pace of price growth in some regions, most experts agree that a more moderate increase in housing prices should be expected across the country in 2025. Thus, Solvia analysts predict growth of 3%, and Bankinter specialists — 4%. One of the factors that can support demand for real estate is a decrease in mortgage interest rates. This makes borrowed funds more accessible to a wide range of buyers and can lead to an increase in the number of transactions, especially in the affordable housing segment.

- On the other hand, some experts fear that the current rate of price growth is already exceeding the level justified by economic realities, and the market is at risk of «overheating». This is especially true for the premium segment, where the cost of luxury properties has increased by 20-30% over the past year. In the event of a worsening economic situation or a sharp increase in loan rates, this segment may be the most vulnerable.

The housing shortage is one of the main problems facing the Spanish real estate market in 2025. According to experts, the country currently lacks at least 600,000 housing units. The reasons for this shortage are rooted in several factors:

- Slow pace of construction — after the global financial crisis of 2008, the volume of new housing construction in Spain fell sharply and has not yet returned to its previous level. Many developers prefer to focus on more expensive and profitable projects, ignoring the affordable housing segment.

- Difficulties in obtaining building permits — bureaucratic red tape and strict requirements for new projects from local authorities significantly slow down the process of launching new construction projects. As a result, many projects are unprofitable or postponed indefinitely.

- Rising construction costs — prices for building materials and labor have been steadily rising in recent years, making the construction of new housing increasingly expensive. This, in turn, is reflected in the final cost of properties and reduces their availability to potential buyers.

The lack of supply on the market leads to the fact that prices for existing properties are growing faster than incomes. This makes the purchase of their own home unaffordable for many Spanish families, especially in large cities and popular tourist regions.

Install our app and get all the tools you need to search for real estate abroad in your smartphone! The mobile application will allow you to quickly access your personal account, manage your favorite properties and track your requests, directly exchange messages with sellers and buyers.

New rules and taxes -what awaits buyers and investors

- In an attempt to cool the red-hot property market and make housing more affordable, the Spanish government is considering introducing a number of new rules and taxes. In particular, the possibility of increasing taxes on the purchase of housing for foreigners who are not EU residents is being discussed. Supporters of this measure argue that it will help limit speculative demand for real estate and make the market more stable. However, critics fear that this will lead to an outflow of foreign investment and negatively affect the country's economy as a whole.

- Another potential change is tightening the rules on rental housing. The authorities plan to tighten controls on landlords and limit the growth of rents in popular tourist areas. This could lead to some investors buying property for rent leaving the market, which will reduce demand and slow down price growth.

Other factors influencing the real estate market

In addition to economic and legislative factors, the situation on the Spanish real estate market is influenced by a number of other trends:

- Demographic changes — the Spanish population is aging, and more and more older people prefer to move to smaller apartments or houses located in cities with developed infrastructure and access to medical services. This increases the demand for certain types of real estate and affects pricing.

- Immigration — Spain remains a popular destination for immigrants from Latin America, Africa and Eastern Europe. The influx of new residents with different income levels increases the demand for housing, especially in the rental and affordable real estate segments.

- Changing buyer preferences — the COVID-19 pandemic has forced many to reconsider their priorities when choosing a home. More and more people are looking to buy spacious houses with a garden or terrace, located in small towns or suburbs. This changes the structure of demand and affects pricing in different market segments.

- Growing interest in «green» housing — more and more buyers are paying attention to the environmental friendliness and energy efficiency of the property they purchase. Houses and apartments with solar panels, rainwater collection systems and other «green» options are in high demand and can cost more than regular properties.

Investing in real estate — is it worth the risk

- Despite all the difficulties and potential risks, investing in Spanish real estate remains an attractive option for many. Steady price growth, high demand for rent and the possibility of obtaining citizenship through the purchase of real estate make this country one of the most popular destinations for investors from around the world.

- However, experts warn that in the current conditions it is especially important to carefully approach the selection of investment properties. It is necessary to consider not only the potential profitability, but also the liquidity of the property, its location, condition and compliance with new environmental standards.

- In addition, investors should closely monitor changes in legislation and tax policy, so as not to become hostage to new rules and restrictions. Working with experienced local specialists — realtors, lawyers, tax consultants — will help minimize risks and make informed decisions.

In conclusion, we note:

- The Spanish real estate market in 2025 is experiencing a period of rapid growth, but at the same time it faces a number of serious challenges. Record increases in housing prices, especially noticeable in regions such as Madrid, Valencia and the Canary Islands, on the one hand, make real estate investments potentially profitable, but on the other hand, they increase the risks of market “overheating”.

- The shortage of affordable housing, caused by the slow pace of construction, bureaucratic obstacles and rising costs, remains the main structural problem hindering the development of the market. The government is trying to solve this problem with new taxes and restrictions, but the effectiveness of these measures is still questionable.

- Finally, we cannot discount changes in the preferences of buyers themselves, who are increasingly paying attention to factors such as environmental friendliness, infrastructure and quality of life. These trends will have an increasing impact on the market in the coming years and create new opportunities for developers and investors.

Overall, despite all the difficulties and risks, the Spanish real estate market remains one of the most promising in Europe. With the right approach and careful analysis, buying a home here can be a reliable way to save and increase capital, as well as get a lot of pleasure from living in this beautiful country.

Real Estate in Spain

Real Estate in Spain

The Spanish real estate market continues to grow rapidly, especially in the new-build segment. Madrid, Malaga and Valencia are leading in terms of construction volumes, but housing prices are becoming less and less affordable for the majority of the population. Let's look at the reasons for this phenomenon and the prospects for investors and buyers.

Spain is preparing to introduce serious restrictions for foreign buyers of real estate who are not residents of the European Union. The government plans to raise taxes, establish a residency requirement and cancel the “golden visa” program for investors. Experts predict a decrease in the inflow of foreign capital into the housing market.

Malaga, a popular tourist city in southern Spain, is taking drastic measures to regulate short-term rentals for tourists. The new rules affect 43 areas of the city, including the historic center and coastal areas. Authorities are seeking to find a balance between developing the tourism sector and ensuring housing is affordable for the permanent population.

42

42  1

1  1

1  3

3