Australia closes the door — a ban on buying housing for foreigners

Dramatic changes await the Australian property market in the coming years. The country's government has announced a radical decision: from April 1, 2025 to March 31, 2027, there will be a complete ban on the purchase of residential property by foreign citizens. This is an unprecedented step for the country. This decision has caused a storm of discussions both within the country and abroad. For many international investors, Australia was a stable and attractive market with good prospects for growth in asset prices. Now they will have to reconsider their investment strategies for the next two years.

Reasons for the ban — the housing affordability crisis

What led the Australian government to such a radical decision? The main reason lies in the acute housing crisis that the country has been experiencing in recent years. The cost of real estate in major Australian cities — Sydney, Melbourne, Brisbane — is steadily rising, making the purchase of their own home unaffordable for many local residents. The statistics speak for themselves:

- Over the past 5 years, the average cost of housing in Sydney has increased by 35%.

- In Melbourne, the increase was about 28%.

- More than 40% of young Australians under 35 cannot afford to buy their first home.

- The share of foreign investment in the residential property market was about 15% in 2024.

Australian experts note that a significant influx of foreign capital, especially from Asia and the Middle East, has contributed to the heating up of the market and the creation of an artificial deficit. The government hopes that temporarily restricting access to foreign buyers will help balance supply and demand, as well as reduce price pressure.

Details of the ban — what exactly falls under the restrictions

It is important to understand that the ban does not apply to all types of real estate and not all categories of foreign citizens. Let's look into the details:

Objects covered by the ban:

- Finished residential buildings and cottages

- Apartments in apartment buildings

- Townhouses and duplexes

- Land plots intended for housing construction

What remains available to foreign investors:

- Commercial real estate (offices, shopping centers, warehouses)

- Participation in construction projects through the acquisition of shares in development companies

- Long-term lease of residential real estate

Exceptions to the ban:

- Permanent residents of Australia who do not have citizenship

- Spouses/partners of Australian citizens

- Investors from countries with which Australia has signed special free trade agreements (the list will be updated)

- In some cases — foreign citizens moving to Australia for long-term work

Control mechanisms — how the ban will work:

- Mandatory verification of citizenship when registering any real estate transactions.

- Introduction of an electronic buyer verification system.

- Tightening of rules for legal entities and trusts to prevent the acquisition of real estate through shell companies.

- Significant fines for attempts to circumvent the ban (up to 1 million Australian dollars for legal entities).

- Forced sale of illegally acquired real estate.

The Australian government has already announced the creation of a special regulatory body that will monitor compliance with the new legislation. Australian authorities declare zero tolerance for attempts to circumvent the new rules and are ready to apply the strictest sanctions to violators.

Possible consequences for the Australian real estate market

Experts disagree on how the new restrictions will affect the country's real estate market. Let's consider the main scenarios:

Optimistic scenario:

- Reduction in residential property prices by 5-10% during the first year of the ban.

- Increase in housing affordability for local residents.

- Stimulation of domestic demand.

- Redirection of foreign investment to the construction of new housing.

Pessimistic scenario:

- A sharp reduction in construction volumes due to capital outflow.

- A decline in activity in the real estate market as a whole.

- A risk to the economies of regions heavily dependent on foreign investment.

- A possible reduction in the cost of already built housing.

Some analysts also note that the effect of the ban may be short-term, and after its lifting, the market will face a new wave of demand and higher prices.

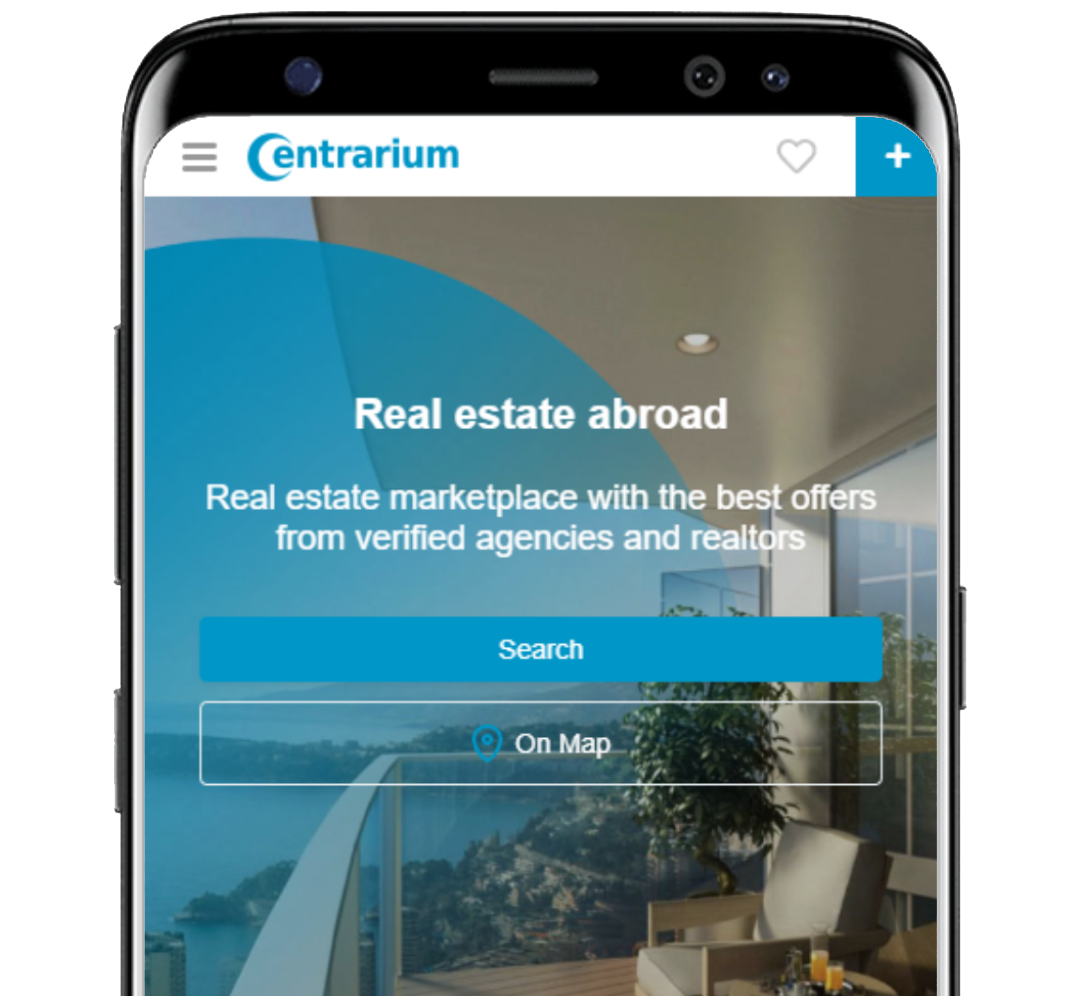

Install our app and get all the tools you need to search for real estate abroad in your smartphone! The mobile application will allow you to quickly access your personal account, manage your favorite properties and track your requests, directly exchange messages with sellers and buyers.

International reaction

The Australian government's decision has caused a mixed reaction around the world. While some countries have expressed understanding of the move, others are concerned about the potential consequences for bilateral relations. The news was particularly acute in China, Singapore and Hong Kong, whose citizens have traditionally been active buyers of Australian property. Representatives of Chinese investor associations have already expressed concern and called for negotiations. European experts note that similar measures are being considered in some EU countries suffering from a housing crisis. Perhaps the Australian experience will become a model for other developed economies. Representatives of the IMF and the World Bank emphasize that such restrictions could negatively affect global capital flows and urge caution in applying such measures.

Alternative options for foreign investors

If you were planning to invest in Australian property but the new rules have disrupted your plans, don’t despair – there are alternative options:

1. Investing in other countries with attractive property markets:

- New Zealand (although they have similar but less stringent restrictions)

- Canada

- United Kingdom

- Portugal with its popular Golden Visa program

- UAE, especially Dubai

2. Investing in the Australian market through other instruments:

- Shares of Australian property-related companies.

- United funds of investment funds specializing in the Australian market.

- Bonds of Australian developers.

How to prepare for the situation – tips for different categories of investors

For those who already own property in Australia:

- The ban is not retroactive and does not affect existing properties.

- Consider investing in improving your existing property.

- If you were planning to sell in the coming years, it may be worth reconsidering your strategy.

For those planning a purchase:

- If you fall into the exception category, prepare all the necessary documents in advance.

- Consider alternative markets or investment vehicles.

- If the purchase is related to moving to Australia for work or study, explore the possibility of long-term rental.

For professional investors:

- Diversify your portfolio by including properties from different countries.

- Consider partnering with Australian companies for joint projects.

- Explore opportunities to invest in the construction of new housing in Australia (this is exempt from the ban, subject to certain conditions).

Expected changes after the ban ends

What will happen after March 31, 2027, when the ban is lifted? Much will depend on the results of this experiment, but experts predict several scenarios:

- A smooth return to the previous rules — if the goals of market stabilization are achieved, a gradual lifting of restrictions is possible while maintaining enhanced control.

- Introducing permanent restrictions — instead of a complete ban, a system of additional taxes and fees for foreign buyers will be introduced, similar to Singapore or Canada.

- Extending the ban — if the initial two-year period does not bring the expected results, the government may consider extending the ban.

What you can do right now: practical steps

If you are interested in investing in real estate, given the new realities of the Australian market, here are some practical steps:

- Read the full text of the new restrictions.

- Consult lawyers specializing in international real estate law.

- Check whether you fall under the exemption category.

- Request analytical reports on the regions you are interested in.

- Compare investment conditions, taxation and growth prospects.

- If you are planning to invest in other countries, start preparing the necessary documents early.

- Check possible visa restrictions of the country of residence.

- Research the tax implications for your country of residence.

Adapting to the new reality

The ban on foreigners buying residential property in Australia presents a major challenge for the international investment community, but also opens up new opportunities. It is important to view this situation not as an insurmountable obstacle, but as an incentive to review investment strategies and find new directions. The global property market continues to offer many interesting options, and using modern online platforms such as Centrarium allows you to explore them without leaving your home. Be flexible, diversify your investments and remember that real professionals always find opportunities even in the most difficult situations.

14

14

16

16

20

20

2

2

Constantly rising prices are increasing inequality between regions and social classes. In this article, we take a closer look at key market trends, barriers to new buyers, and potential for growth. We explain how regional differences, affordability factors, the influence of foreign investors, and market structure are shaping the current Swiss real estate landscape.

The Serbian real estate market is experiencing a period of active growth, attracting the attention of investors from all over the world. The combination of affordable prices, a stable economy, favorable legislation and high development potential makes this Balkan country one of the most promising areas for investment in residential and commercial real estate.

In 2024, the global real estate market showed significant price growth, especially in Turkey, Poland and Bulgaria. The main factors are inflation, increased availability of mortgage lending and active investments. Seoul and Tokyo stand out in the premium segment. In 2025, further moderate price growth is expected, although the dynamics will be uneven across different regions.

54.23

54.23  2

2  1

1  1

1  4

4