Dubai — Trade wars and falling oil prices affect the property market

Dubai, the largest city in the United Arab Emirates (UAE), is known worldwide for its luxury, innovative architecture and dynamic property market. However, in recent years, the emirate has faced a number of serious economic challenges related to trade wars, falling oil prices and general instability in the global economy. These factors have a significant impact on the Dubai property market, which has historically been one of the key drivers of the emirate's economic growth. Global economic shocks, including US President Donald Trump's trade policies and oil price volatility, are taking their toll on the Dubai property market.

The Dubai property market experienced impressive growth between 2020 and 2023, with house prices increasing by approximately 70%. This jump was driven by a number of factors, including the economic recovery from the COVID-19 pandemic, low interest rates and an influx of foreign investment. However, in 2024, the growth rate slowed to 16% compared to 20% a year earlier, indicating that the sector has begun to cool. Experts highlight two main reasons for the slowdown in Dubai property prices:

- Trade wars initiated by US President Donald Trump — the introduction of tariffs and duties on goods from the UAE and other countries had a negative impact on Dubai's export-oriented companies, which in turn affected the property market.

- Significant decline in oil prices — Dubai's property market is historically closely linked to oil revenues, and falling energy prices lead to job losses and a decrease in the number of foreign expatriate professionals, who are an important part of the demand for housing in the emirate.

Impact of Trade Wars on Dubai Property Market

US President Donald Trump’s trade policies have had a multi-layered impact on the global economy and, as a result, on the UAE property market:

- Tariffs and duties — The US has imposed a 10% tariff on UAE goods, which has deprived Dubai companies of a competitive advantage in the US market. Large exporters such as aluminum, steel, machinery and food producers have been particularly hard hit. These changes have forced players to rethink their pricing policies and trade strategies.

- Impact on the oil market — Increased tariffs on China, the largest importer of Middle Eastern oil, have caused further instability and reduced demand. Given Dubai’s reliance on oil revenues, this has had a negative impact on the sector.

- Risks for international investors and expats — The high level of international investment makes Dubai’s property market vulnerable to global economic downturns. In an environment of instability, investors may be reluctant to make large investments, especially if there is uncertainty in their own markets. The regional economic downturn is also reducing jobs for expats, a group that has been a major driver of price dynamics in recent years. However, the introduction of so-called “golden visas” helps retain foreign residents even in a slowing economy, mitigating the potential outflow of capital and specialists.

Falling Oil Prices and Its Impact on Dubai

Dubai’s economy, while more diversified than other emirates, remains heavily dependent on oil revenues. Falling energy prices impact the property market through several mechanisms:

- Cutting government spending – falling oil revenues are forcing the Dubai government to cut spending, including on infrastructure projects and property development. This is leading to a slowdown in construction activity and a cooling market.

- Decreasing expat population – low oil prices often lead to job losses in the oil and gas sector and related industries. Since expats make up a significant portion of Dubai’s population and are important buyers and renters of property, their outflow has a negative impact on demand and prices.

- Decreasing investor confidence – falling oil prices can be perceived by investors as a sign of economic instability in the region, leading to decreased confidence and caution when investing in Dubai property.

The Dubai government recognizes the risks associated with dependence on oil revenues and is taking steps to diversify the economy:

- Tourism Development — Dubai is actively investing in tourism infrastructure, attracting visitors from all over the world. This helps reduce dependence on oil revenues and supports demand for real estate, especially in the hotel and resort real estate segment.

- SME Support — The emirate creates a favorable environment for the development of entrepreneurship, which contributes to job creation and economic growth unrelated to oil.

- Investment in Innovation and Technology — Dubai aims to become a regional hub for innovation, attracting start-ups and tech companies. This creates new opportunities for economic growth and demand for commercial real estate.

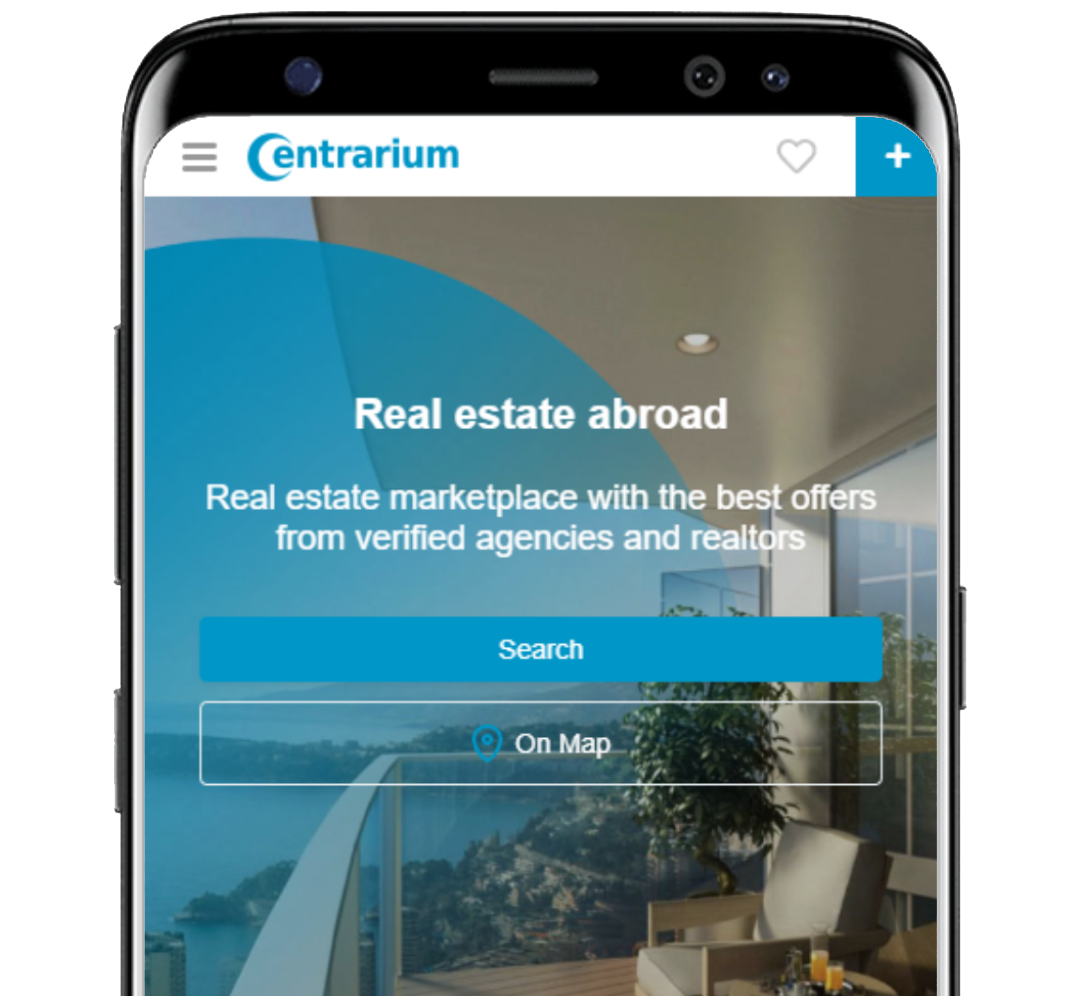

Install our app and get all the tools you need to search for real estate abroad in your smartphone! The mobile application will allow you to quickly access your personal account, manage your favorite properties and track your requests, directly exchange messages with sellers and buyers.

Dubai's Response and Strategy in the Context of Economic Challenges

In response to trade wars and US protectionist policies, the Dubai government has taken a number of measures to mitigate the negative impact:

- Customs Concessions — Dubai has reduced customs duties on certain categories of goods to support local manufacturers and exporters.

- Deepening ties with other trading partners — The Emirate is actively developing trade relations with countries in Asia and Africa to compensate for losses in the American market.

To reduce dependence on external markets, Dubai is focusing on developing local production and stimulating domestic demand:

- Supporting local manufacturers — the government provides subsidies and incentives to companies that localize production in Dubai, which creates jobs and reduces dependence on imports.

- Stimulating domestic consumption — through various loyalty programs and discounts, Dubai encourages local residents and expats to buy goods and services within the emirate, thereby supporting economic activity.

To retain foreign investors and professionals even in conditions of economic instability, Dubai has introduced «golden visas» — long-term residence permits for up to 10 years. This initiative is designed to provide stability and predictability for expats, which, in turn, supports demand for real estate and contributes to the inflow of investment even during global economic downturns.

Global Shifts and Opportunities for Dubai

- The Diamond Market Shifts to Dubai — Trade wars and geopolitical tensions have led to an interesting shift in the global gemstone market. Traditional diamond certification centers such as Antwerp and some US cities are losing ground, while Dubai is actively strengthening its infrastructure in this area. With developed logistics, a favorable business climate and a strategic location, the emirate is well positioned to become a new world leader in diamond and gemstone trading.

- Potential for New Industries — The economic challenges of recent years have pushed Dubai to seek new opportunities for growth and diversification. Some promising areas include:

- Development of Renewable Energy — Dubai is investing in solar energy and other clean technologies, aiming to become a regional leader in this area.

- Strengthening Position in Islamic Finance — The emirate is developing infrastructure and regulation to attract Islamic financial institutions and investors.

- Becoming a Crypto Hub — Dubai is creating a favorable environment for blockchain startups and crypto companies, aiming to become a global hub for innovation in this field.

The development of these and other promising industries will help Dubai reduce its dependence on traditional sources of income and support demand for commercial and residential real estate.

In conclusion, the trade wars initiated by the Donald Trump administration and the fall in oil prices have created significant challenges for the Dubai real estate market. Slowing price growth, risks for international investors and expats, and general economic instability require the emirate to be adaptive and innovative. However, thanks to a well-thought-out strategy that includes economic diversification, support for local businesses, attracting foreign investors and developing new promising industries, Dubai has demonstrated resilience in the face of global economic shocks. Flexible regulation, long-term planning and openness to innovation allow the emirate to remain attractive to investors and maintain demand for real estate even in an unstable environment. In the long term, Dubai’s ability to adapt to changing economic realities and seize new growth opportunities will determine the resilience and success of the emirate’s real estate market. As the global economy continues to evolve and transform, Dubai will need to continue to demonstrate flexibility, creativity and forward-looking thinking in its economic policies and real estate development strategy.

2

2

14

14

57.18

57.18  2

2  1

1  1

1  1

1  7

7

10

10

92.3

92.3  1

1  1

1  1

1  3

3

The fallout from Donald Trump’s trade wars and falling oil prices pose risks to Dubai’s property market. This article examines the reasons for the slowdown in property prices, the impact of international investment, new challenges for expats and shifting global economic dynamics, and the strategies Dubai is using to mitigate the impact of economic shocks.

Dubai launches a revolutionary real estate tokenization project, opening up new opportunities for investors worldwide. Find out how this initiative is transforming traditional approaches to real estate investing, reducing barriers to entry, and driving innovation in the global market. Join the discussion about the future of real estate investing in the digital age.

Dubai is one of the fastest growing and most innovative cities in the world, attracting millions of investors and tourists every year. With a diversified economy, cutting-edge technology, unique infrastructure and favorable business conditions, Dubai has become a true leader not only in the Middle East but also around the world.