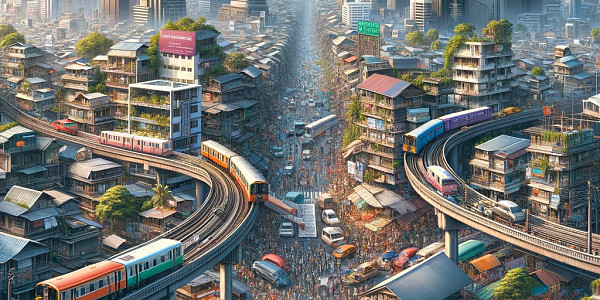

Thailand at a crossroads — how to save the real estate market in a crisis

Thailand, one of the most popular tourist and investment destinations in Southeast Asia, is facing serious challenges in the real estate sector. A combination of external crises such as the trade war between the US and China, a devastating earthquake in neighboring Myanmar, and domestic economic problems have threatened the stability of the country's housing sector. Developers and professional associations are sounding the alarm, calling on the government to take decisive action to support the industry. Without prompt intervention from the authorities, the real estate market risks entering a protracted recession, which will negatively affect the entire Thai economy. Among the priority measures that market participants expect from the authorities:

- Tax incentives and subsidies — a temporary reduction in taxes on real estate transactions and the provision of subsidies to developers will help support the industry in the short term.

- Buyer support programs — subsidizing mortgages for low-income citizens and young families, as well as simplifying the procedure for obtaining loans will contribute to the growth of domestic demand.

- Liberalization for foreign investors — lifting restrictions on property ownership for foreign buyers, such as increasing condominium quotas and extending land lease terms, will attract foreign capital to the country.

Proposals from professional associations

Among the key factors that caused the slowdown in the housing sector, experts highlight two main ones:

- Reduction in the inflow of foreign investment — strict restrictions on property ownership for foreigners and general uncertainty of the economic situation led to a decrease in the interest of foreign buyers and investors in the Thai market.

- Decrease in domestic demand — a decrease in household incomes against the backdrop of inflation and a decrease in the availability of mortgage loans have negatively affected purchasing activity within the country.

In addition, long-term trends such as rising prices for building materials, rising interest rates and increased competition from neighboring countries in the region are also putting pressure on the sector.

Leading associations of developers and realtors in Thailand, including the Thailand Condominium Association (TCA), the Thailand Real Estate Association (TREA) and the Housing Development Association (HBA), have issued a joint statement outlining the necessary measures to support the industry. They propose dividing the actions into two levels:

- Immediate steps — a rapid reduction in taxes on real estate transactions and registration, temporary tax breaks and subsidies for construction companies, government support programs for low-income buyers and young families, simplifying the procedure for obtaining mortgage loans.

- Long-term solutions — legislative changes to attract foreign investors (increasing the ownership quota in condominiums to 75%, extending land lease terms to 99 years), a program to modernize the housing stock with a focus on «green» and energy-efficient technologies, the development of new investment areas, such as medical clusters to increase demand for quality real estate.

Potential for Foreign Investment

Despite the current difficulties, Thailand remains an attractive destination for foreign property buyers, especially from Russia and the CIS countries. Growing interest from foreigners could become a driver of market recovery if the country's authorities lift restrictions in a timely manner. As experts emphasize, the influx of foreign capital will support the sector during the crisis and lay the foundation for subsequent sustainable growth. At the same time, it is important to maintain a balance between market liberalization and protecting the interests of the local population.

Install our app and get all the tools you need to search for real estate abroad in your smartphone! The mobile application will allow you to quickly access your personal account, manage your favorite properties and track your requests, directly exchange messages with sellers and buyers.

«Green» construction as a growth point

Some developers are betting on eco-friendly and bio-circular projects, which are supported by both the state and international organizations. Although «green» buildings are 20-30% more expensive to build, they are much more economical to operate, which increases their attractiveness for buyers and tenants. The development of this area could become one of the long-term growth drivers of the Thai real estate market, combining economic and environmental advantages.

International experience of overcoming real estate crises

Thailand is not the only country facing problems in the housing sector. Global experience shows that competent actions by the authorities can help overcome crisis phenomena and put the market on a sustainable development trajectory. Thus, after the global financial crisis of 2008, many countries took measures to support their real estate markets:

- The United States launched a program of preferential mortgage lending and buyouts of distressed assets, which helped stabilize prices and restore consumer confidence.

- Spain liberalized legislation for foreign investors, giving them the opportunity to obtain a residence permit when purchasing real estate worth at least 500 thousand euros.

- Singapore focused on the development of “smart” and eco-friendly areas, such as Punggol Eco-Town, attracting buyers with quality of life and innovative solutions.

This experience can also be useful for Thailand, adapting the best global practices to local realities and needs.

The Future of Thailand's Property Market

Despite current challenges, the long-term outlook for Thailand's property market remains positive. The country has a number of advantages that continue to attract both domestic buyers and foreign investors:

- Attractive geographical location — Thailand is located in the heart of Southeast Asia, with access to the sea and borders with the region's rapidly growing economies.

- Developed infrastructure — the country is actively investing in the modernization of the transport network, the construction of modern airports, ports and public transport systems.

- Favorable climate and natural beauty — a tropical climate, clean beaches and diverse landscapes make Thailand an attractive place to live and relax.

- Competitive property prices — despite the rise in housing costs in recent years, prices in Thailand remain more affordable compared to many other countries in the region.

- Developed tourism industry — Thailand is one of the most popular tourist destinations in the world, which creates a steady demand for housing, especially in the short-term rental segment.

If the government can effectively confront the current challenges and implement the necessary support measures, these benefits will help the Thai real estate market not only overcome the crisis, but also reach a new level of development in the long term.

In summary, the Thai real estate market is going through a difficult period caused by a combination of external shocks and internal problems. Developers and professional associations are calling on the government to take decisive action to prevent a recession and maintain housing affordability for the population. Necessary measures include tax cuts, subsidies for buyers and developers, liberalization for foreign investors and support for «green» construction. International experience shows that competent actions by the authorities can help overcome the crisis and put the market on a trajectory of sustainable growth. Despite the current difficulties, Thailand has significant potential for real estate market development due to its attractive geographical location, developed infrastructure, favorable climate and competitive prices. Not only the future of the housing sector, but also the trajectory of the entire economy of the country depends on the effectiveness of the government's actions. Only a comprehensive approach that takes into account the interests of all market participants and is based on the best global practices will allow Thailand to successfully overcome current challenges and lay the foundations for sustainable development of the real estate market in the long term.

6

6

25.1

25.1  1

1  1

1  1

1  2

2  5

5

13

13

10

10

External shocks and internal problems threaten the stability of one of the key sectors of the Thai economy. Developers and professional associations are calling on the government for urgent support measures to avoid recession and maintain housing affordability for the population. Experts suggest tax incentives, attracting foreign investment, developing new clusters and introducing “green” technologies in construction.

Bangkok is experiencing a boom in the serviced apartment market, which attracts investors with high returns and tenants with the convenience of living. Let's look at the features, trends and best projects of this promising segment of real estate in the Thai capital.

We look at current trends in the Thai property market, including rising prices, strong demand from foreign investors, and market forecasts. Find out which regions and property types are most popular with buyers.